As a business owner, you keep a keen eye on your bottom line. From operational expenses to employee management, every aspect demands careful attention. However, in pursuit of profitability, some elements lurk in the shadows, silently impacting the business over time.

Your experience modification factor (e-mod) is one such element.

At the heart of your workers compensation premium calculation is your e-mod. This one factor can save you thousands of dollars annually or cost you lucrative contracts. Knowing how it works – and how to improve it – gives you more control over your work comp insurance costs.

For a quick overview, watch MEM Senior Safety and Risk Consultant Brad Minor explain the basics. Then, read on for everything you need to know.

What is an experience modification factor (e-mod)?

Think of your e-mod as your business’s safety report card. Work comp companies use it when determining how much you’ll pay for coverage.

The basics of e-mod

Your e-mod compares your company’s claims history to that of similar businesses in your industry. It’s a simple number: 1.0 represents average performance for companies like yours.

➡️ Here’s how the scoring works: If your e-mod is below 1.0, you’ve had fewer or less costly claims than expected, earning you a premium discount. Above 1.0 means more or costlier claims, resulting in a premium surcharge.

Not all businesses have an e-mod. The qualifications vary by state based on years in business and premium amount.

How your e-mod affects your premium

Work comp premiums follow a straightforward formula:

Payroll × classification rate × e-mod = premium

Your e-mod acts as the final multiplier, which means it affects your entire premium amount.

Here are some examples of how different e-mods impact your premium:

| E-mod rating | Premium impact | Safety implications |

| 0.70 | 30% discount | Exceptional safety record |

| 0.85 | 15% discount | Better than average record |

| 1.00 | Standard rate | Industry average |

| 1.15 | 15% surcharge | Worse than average record |

| 1.30 | 30% surcharge | Poor safety record |

This difference can add up quickly. An e-mod of 0.85 saves you 15% on your premium, while an e-mod of 1.1 costs you 10% more. For a business with a baseline annual premium of $100,000, that’s a $25,000 difference between the two ratings.

📍 We break down the complete premium picture in this guide: How Your Workers Compensation Premium is Calculated >

How is your e-mod calculated?

Unlike payroll or classification codes, which reflect your business size and type, your e-mod is the premium factor you can most directly influence through safety practices and claims management.

Understanding how your e-mod is calculated helps you see exactly where you have control over the outcome.

The data behind your e-mod

The e-mod calculation looks at how often you have claims (frequency) and how expensive they are (severity).

Then, your claims history is compared to what’s expected for businesses of your size in your industry. The National Council on Compensation Insurance (NCCI) maintains data on thousands of companies to establish these benchmarks.

💡 Did you know? Frequent small claims can hurt your e-mod more per dollar than single large claims because they signal ongoing safety problems rather than isolated incidents.

Understanding the e-mod timeline

Your e-mod uses three years of claims data, but not the most recent years. We exclude the current and previous years because claims reported during those years are still developing. Medical costs can change, and new claims might still be reported.

Because of this lagging nature, changes to your safety performance don’t show up in your e-mod immediately. A claim today won’t affect your rating for 1-2 years, and the impact will resonate 4-5 years post-incident.

“The e-mod is a snapshot of an employer’s third, fourth and fifth past years of claim costs,” explained Steve Summers, MEM Field Service Manager. “If you have a bad year, you’ve got to live with it for three years that way.”

To be clear, the safety improvements you make today do deliver immediate benefits: fewer injuries, better morale, and higher productivity. However, seeing their impact on your e-mod takes patience.

☑️ The bottom line: While there are no quick fixes for a damaged e-mod, understanding the timeline helps you commit to long-term safety efforts and manage expectations.

The true costs of a high e-mod

A high e-mod can affect your business in several ways, from premium increases to lost contract opportunities. Since your e-mod incorporates years of claims information, today’s decisions have real long-term financial implications.

Direct financial impact

Premium increases are the most obvious cost of a high e-mod. A business with a 1.25 e-mod pays 25% more than one with a 1.0. That 25% can translate to thousands annually for many companies.

➡️ Here’s an example: Two landscaping companies in the same area have similar payroll. Company A has an e-mod of 1.20, and Company B has 0.85. On a $50,000 annual premium, Company A pays $17,500 more per year. That’s more than $87,000 over five years that could have funded equipment, training, or expansion.

Business competitiveness and reputation

In addition to its impact on work comp premium, a high e-mod can also limit your ability to compete for work in some industries.

Many contractors require subcontractors to maintain e-mods below 1.0. If yours is higher, you’re automatically disqualified from bidding, regardless of your skills, pricing, or experience.

“For a lot of state and federal work, if you have over a 1.0, you may not be able to bid on work,” explained Terry Sweeten, MEM Field Service Manager. “If you can’t bid on work, you can’t get a job, and you can’t keep your employees working.”

A deteriorating e-mod creates a cycle where you’re forced into smaller, lower-margin work, making it harder to invest in the safety improvements that would help reduce your e-mod.

Workplace and operational impacts

Beyond insurance costs and competitiveness, there’s a larger story behind what it means to have a high e-mod. It means your safety program isn’t performing as it should.

Frequent injuries create a cycle of disruption that affects every aspect of your operations:

- Lost productivity: Work stops for investigations and incident response

- Overtime costs: Other employees cover additional duties and shifts

- Management distraction: Leadership attention shifts from productive activities to crisis management

- Decreased morale: Employees feel less safe at work

- Higher turnover: Employees leave for safer environments, creating recruiting and training costs

- Reduced efficiency: Inexperienced replacement employees perform at lower levels

- Regulatory scrutiny: Poor safety records invite additional compliance challenges

Minor explained: “If we can keep people from getting hurt in the workplace, there’s going to be better morale among the employees. They’re going to be safer while they’re coming to work. They won’t have lost time.”

A high-performing safety program leads to better employee retention, higher productivity, and a stronger workplace culture that supports your e-mod improvement efforts.

How to improve your e-mod: 2 essential strategies

Improving your e-mod comes down to two things:

- Preventing workplace injuries

- Managing claims effectively

Together, these two goals reduce claim frequency and severity to improve your rating over time.

Preventing injuries with a comprehensive safety program makes the biggest impact because it means you avoid direct claim costs and indirect disruption costs. Your program should include:

- Written safety rules

- Regular safety meetings

- Post-offer employment testing

- Safety training

- Incident investigation

- Safety equipment and technology

Effective claims management focuses on making sure the injured worker gets the appropriate care and minimizing claim costs with strategies like:

- Timely injury reporting

- Telehealth and nurse triage

- Directed medical care when possible

- Return to work plan with modified or light duty

- Post-incident drug and alcohol testing

- Fraud prevention

Put these and other cost-saving strategies to work with our playbook: 4 Proven Ways to Reduce Your Workers Compensation Costs >

Partnering with the right work comp carrier

The insurance carrier you work with impacts your ability to improve your e-mod and overall safety performance. Not all carriers provide the same level of support or the tools to help you make data-driven decisions.

At MEM, we use specialized software to analyze and project how different actions will impact your e-mod. We can show you exactly how a claim would affect your rating and forecast based on your current trajectory.

Our Director of Safety and Risk Services, Brandon Jones, explained how important this visibility is: “A lot of times, I can show a few of the reports to the employer, and that’s all it takes for them to change their operations to make it safer.”

Partner with a carrier that provides insight into your e-mod performance – and the safety resources and support to make long-term positive changes.

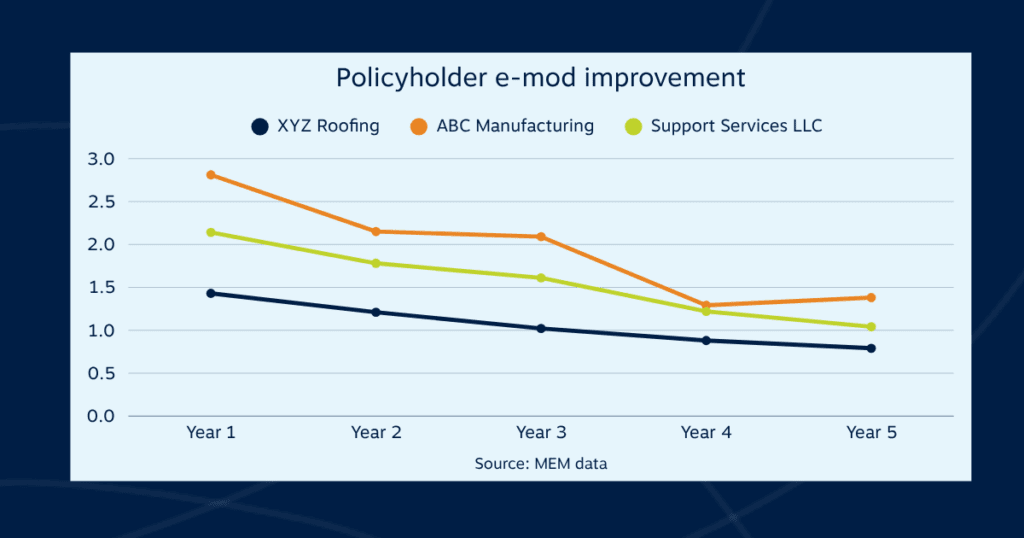

Case studies: How 3 policyholders reduced their e-mods

At MEM, we’ve been helping businesses improve their e-mods for decades. Here are three examples of real policyholders (names anonymized) who reduced their e-mods over five-year periods with us.

XYZ Roofing reduced their e-mod from 1.43 to 0.76 with comprehensive safety changes:

- Quarterly safety meetings with MEM

- Pre-work safety training with jobsite-specific fall protection checklists

- A new managed medical care solution

ABC Manufacturing took their e-mod from 2.81 to 1.38 with claims management strategies:

- Plan to report claims within 24 hours to reduce costs

- Report Only option for small medical claims (which don’t count against e-mod)

- Partnership with MEM’s safety consultants to prevent repeat injuries

Support Services LLC lowered their e-mod from 2.14 to 1.02 with new safety equipment and claims management:

- Two MEM Safety Grants for new equipment

- Return to work resources and light duty alternatives

📍 Read the full stories: Case Studies: How 3 Real Businesses Improved Their E-Mods >

Checklist: Your next steps

Ready to improve your e-mod? Follow this checklist to assess your current situation and identify improvement opportunities:

Analyze your e-mod performance:

- Request your e-mod history from your carrier or agent

- Compare your rating to the 1.0 industry average

- Look for trends over the past 3-5 years

Evaluate your safety programs:

- Honestly assess: Are your safety measures preventing incidents or just checking compliance boxes?

- Schedule a comprehensive safety audit

- Identify your top 3-5 workplace hazards

- Review your incident investigation process

Review your claims management:

- Examine your incident response time (aim for immediate response)

- Assess your options to direct medical care

- Evaluate your return-to-work programs

Track your progress:

- Monitor leading indicators (safety training completion, near-miss reporting)

- Track lagging indicators (claim frequency, severity, e-mod changes)

- Set specific e-mod improvement goals

- Schedule regular progress reviews with your team

☑️ The bottom line: Safety programs work. According to OSHA data, employers with top-tier safety programs have 52% fewer lost-time cases than industry averages. Lower claim rates mean better e-mods and lower premiums.

Work with confidence: Your e-mod as a competitive advantage

Is your e-mod holding you back? You can transform it from a limiting factor into a strategic advantage.

Businesses with excellent e-mods don’t just save money on work comp – they win more contracts, attract better employees, and build more sustainable operations.

Ready to build the safety program that will improve your e-mod? Start with the fundamentals: Foundations of a Workplace Safety Program and Why You Need One >